The subscription model is a business model where a customer is charged a recurring price at a regular cadence, usually monthly or yearly. Subscription models are not new, with book subscriptions going back to the seventeenth century. The rise of the digital economy and SaaS (Software As A Service) has seen subscriptions and recurring revenue become more and more prominent due to internet delivered services, improvement in payment technologies and the attraction of continuing revenue streams.

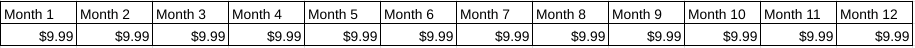

Two important factors to consider when thinking about recurring revenue are price and time. For example, Netflix charges $9.99 (price) per month (time) to subscribe to their basic plan.

This generates $9.99 of recurring revenue per month, and $119.88 of recurring revenue per year if the customer doesn’t cancel the subscription during the 12 month period.

$9.99 (price) x 12 months (time) = $119.88

The commonly used terms for these values are:

MRR (Monthly Recurring Revenue) and

ARR (Annual Recurring Revenue)

Having a continual flow of recurring revenue into the business means that managers can more accurately predict revenue over time and focus on retaining and growing that revenue within their customer base.

The subscription model does come with its challenges, with the churn being one of the most impactful. Churn is a measurement of attrition, a measure of the customers that have left a subscription service in a given time period. The churn rate is usually given as a percentage and is used as a key metric for customer retention. If your churn rate increased over time, you are losing a increasing rate of customers.

For example, using the Netflix example above let’s say there were 100 subscribers of the basic plan.

100 users x $9.99 (price) per month (time) = $999.00 MRR (Monthly Recurring Revenue).

If 8 users decided one month that they were no longer happy with the service they were subscribing and cancelled this would mean that Netflix loses 8 users x $9.99 equaling $79.92 worth of churned revenue.

To calculate the churn rate we use the formula:

(Churned MRR / MRR at the start of the month) x 100

Which in this case is:

($79.92/$999) x 100 = 8%

We call this metric gross churn as we are not considering any new subscribers that have signed up during the month.

So how do we improve gross churn? To improve gross churn we need to reduce it, and to reduce gross churn we need to reduce the number of customers that cancel their subscription.

Leave a Reply